Crypto Investing from Scratch: A Step-by-Step Guide

Let's take a look at each step of the way to crypto investing, from choosing a platform to building your own portfolio.

Getting to Know the Basics of Cryptocurrency

Before you start investing, it's important to understand the basic principles behind cryptocurrency. Cryptocurrency is a digital currency that runs on blockchain technology. It is decentralized, meaning it is not controlled by banks or governments, and is secured by cryptography. The main goal of most cryptocurrencies is to provide an alternative to traditional financial systems by ensuring the security and privacy of transactions.

Some key terms:

Blockchain is a distributed ledger of data that records all transactions on the network.

Wallet is a software or hardware device for storing cryptocurrencies.

Token is a digital asset that can represent both a currency and a share in a project.

Exchange is an online platform for buying and selling cryptocurrencies.

Choosing a Platform for Investing

To buy and store cryptocurrencies, you need to choose a platform that will serve as an intermediary in your transactions. What to look for when choosing:

Security: Choose a platform with a high level of data and asset protection. Pay attention to two-factor authentication and user reviews.

Cryptocurrency support: Make sure the platform supports the assets you are interested in.

Interface: For beginners, a platform with a simple and intuitive interface, without complex terms and graphs, is suitable.

Fees: Estimate the size of the commission for buying and selling assets. Typically, fees are between 0.1% and 1%.

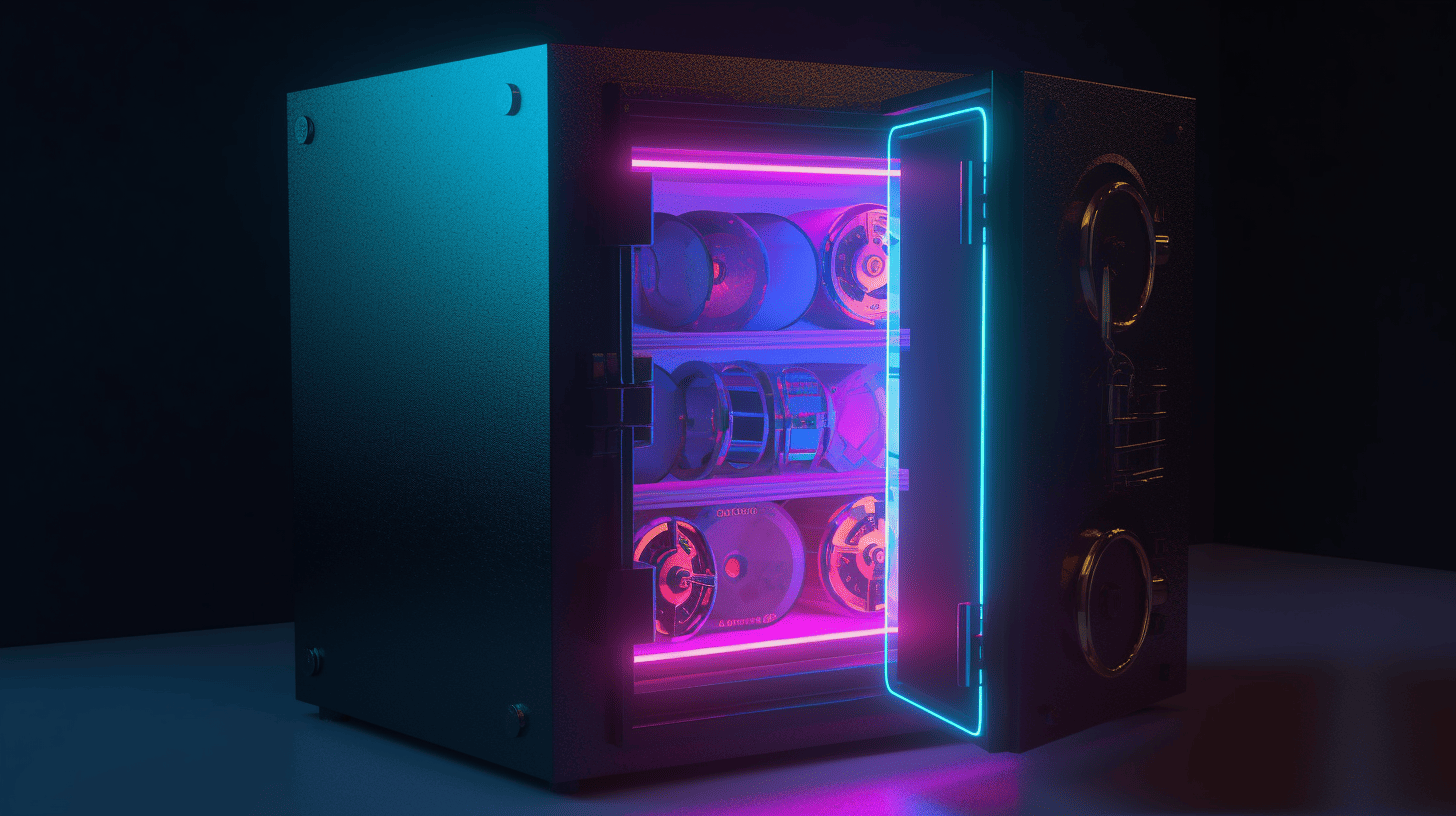

Creating a cryptocurrency wallet

A wallet is where you will store your cryptocurrencies. Wallets can be:

Hot: connected to the Internet (online wallets and mobile apps). Convenient, but less secure.

Cold: offline devices, such as hardware wallets, that store assets offline. Provide a high level of security.

For beginners, it is optimal to use a hot wallet for small amounts and a cold wallet for larger investments. This helps to balance convenience and security.

Choosing Cryptocurrencies to Invest in

Once you have your wallet set up, you need to decide which cryptocurrencies to invest in. Here are some popular options to get you started:

Bitcoin (BTC): The oldest and most popular cryptocurrency. It is considered “digital gold” and has the largest market cap.

Ethereum (ETH): The second most popular cryptocurrency, also known as “digital oil” due to its role in powering blockchain applications.

Litecoin (LTC): One of the oldest altcoins, it offers fast and cheap transactions.

Stablecoins: Cryptocurrencies pegged to the dollar, such as USDT. This is a good way to store assets without volatility.

Developing an Investment Strategy

Define your strategy based on your financial goals and risk tolerance. Here are some approaches to crypto investing:

HODLing: Buying and holding cryptocurrency for a long time. It is suitable for those who believe in the growth of the industry.

Trading: buying and selling assets for short periods of time. Suitable for active investors, but requires a deep understanding of the market.

Portfolio diversification: spreading investments across several cryptocurrencies to minimize risks.

Buying cryptocurrency

Once you have decided on an asset and a strategy, you can start buying. Most exchanges offer a simple process:

Fund your exchange account using a bank transfer, card, or other method.

Select the cryptocurrency you want to buy and enter the amount.

Complete the purchase by following the platform's instructions.

After the purchase, transfer the cryptocurrency to your wallet for safety if you do not plan to actively trade.

Risk management

Cryptocurrencies are known for their high volatility, so it is important to understand and manage the risks. Here are some useful tips:

Invest only what you can afford to lose: high returns come hand in hand with risks, so it is wise to invest an amount that the loss of which will not have a serious impact on your financial situation.

Don't give in to emotions: avoid buying and selling on the wave of news, try to stick to a strategy.

Maintain diversification: distribute your capital between different cryptocurrencies to minimize losses when one of them falls.

Investment tracking

It is important to regularly monitor the state of your portfolio to assess its effectiveness and, if necessary, adjust your strategy. To do this, you can use:

Portfolio tracking apps: such as CoinMarketCap, Blockfolio, or CoinStats.

Analytics platforms: such as TradingView to track prices and study charts.

Taxes and regulations

Depending on your country, profits from cryptocurrency trading may be subject to taxation. It is recommended to familiarize yourself with the laws of your jurisdiction to avoid problems in the future. Some countries offer special tax incentives or specific rules for crypto assets that may be useful.

Education and self-development

The cryptocurrency market is changing rapidly, so it is important to constantly learn and stay up to date:

Reading news sources: Subscribe to sites like CoinDesk, CoinTelegraph, and The Block to stay up to date with the latest developments.

Studying analytics: Understanding market cycles and news will help you make more informed decisions.

Attending webinars and participating in communities: Participating in crypto communities, forums, and chats will help you share experiences and learn from professionals.

Conclusion

Investing in cryptocurrency can be complicated, but it can be made easier if you follow a structured approach. Use this guide as a basic plan to start your crypto journey with confidence. Remember, the crypto market is full of opportunities, but it requires attention and discipline.

Academy

Write your feedback about the project to the support service. Your opinion is very important to us.

All Articles

Instructions for Secure Cryptocurrency Storage

This article provides a detailed guide on how to maximize the security of your funds, explores key storage methods, and highlights why Crypgex is a safe solution for managing your assets.

Take the training: from beginner to crypto expert

We are excited to announce our new partnership with Byacademy, a leading educational platform that helps beginners navigate the world of cryptocurrency and gain confidence on their path to financial freedom.